Ripple is moving deeper into the plumbing of the global financial system, positioning XRP as a critical tool for institutional settlement rather than just a speculative asset.

The company’s latest strategy outlines how XRP is transitioning into a core infrastructure layer for payments and liquidity.

DISCOVER: Top 20 Crypto to Buy in 2026

What This Means for XRP and Institutional Adoption

If you are new to crypto, the term “institutional settlement” might sound dry, but it is incredibly important. Think of it as the moment money actually changes hands between big banks or financial firms. Right now, this process is slow and expensive.

Ripple aims to fix this by using XRP as a bridge, allowing value to move in seconds rather than days.

Just in: @Ripple outlines institutional DeFi blueprint for XRPL with compliance-focused infrastructure positioning $XRP as settlement and bridge asset. pic.twitter.com/j7m5o4ADQy

— CoinDesk (@CoinDesk) February 6, 2026

This isn’t about retail investors trading coins on an app; it is about regulated financial giants using blockchain technology to clear transactions. This concept is often called “Institutional DeFi” (Decentralized Finance).

It brings the speed of crypto to the safety-obsessed world of traditional banking. By embedding XRP into this workflow, the network moves away from relying solely on market sentiment and toward essential daily utility.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

How Ripple Is Building the Infrastructure

To make this vision work, the technology needs to be more than just fast—it has to be useful for complex financial products. **Ripple** recently released an insight detailing how the XRP Ledger (XRPL) is evolving to support these needs. The strategy focuses on specific “building blocks” like payment processing, liquidity, and on-ledger credit.

According to the report, new features are being rolled out to support these workflows. These include “Single-Asset Vaults” and a new Lending Protocol (XLS-66), which allow institutions to borrow and lend directly on the blockchain. Instead of these features acting alone, they are designed to work together.

“Each feature is not a silo, it’s a building block for composable financial ecosystems, tied together by XRP.”

XRP is emerging as the backbone for real-world financial infrastructure.

Take a look at the Institutional DeFi roadmap below. It lays out exactly how the XRP Ledger is evolving into a daily use layer for institutions, with XRP powering settlement, FX, collateral, and on-chain…

— Reece Merrick (@reece_merrick) February 6, 2026

Furthermore, recent moves in the space underscore this institutional focus. For example, partnerships in custody and security are paving the way for banks to hold and use these assets safely. XRP is used to pay transaction fees and fulfill reserve requirements in this ecosystem, creating a constant, functional demand for the token.

Why Utility Matters More Than Price Speculation

Why should you care about settlement layers if you are just holding XRP? The answer lies in sustainability. In the crypto world, prices often spike based on hype or rumors. However, hype eventually fades. Utility: actual people and businesses that need the token to make their software work create a price floor.

If Ripple succeeds in making XRP the standard for institutional settlement, demand for the token becomes tied to global economic activity rather than just investor mood. However, you should also be aware of the risks. Institutional adoption is a slow, bureaucratic process.

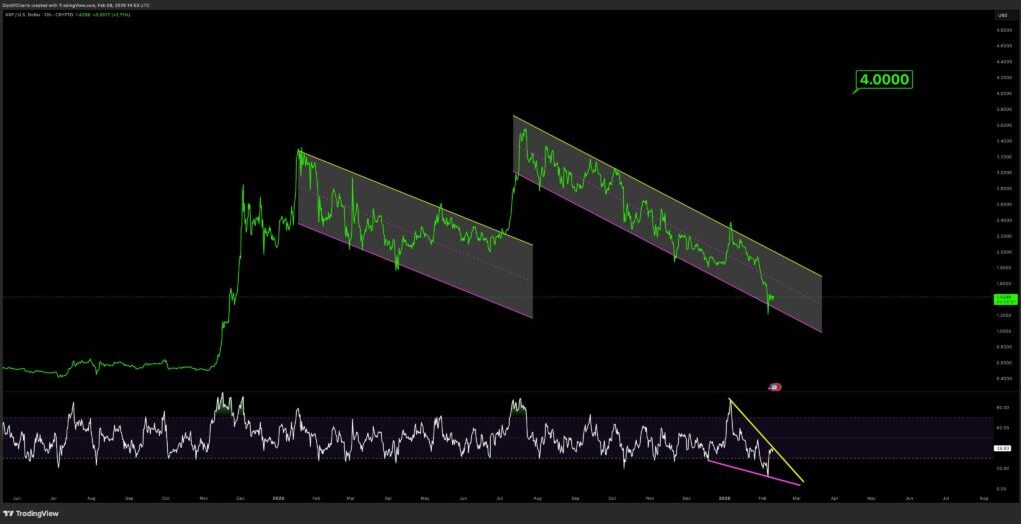

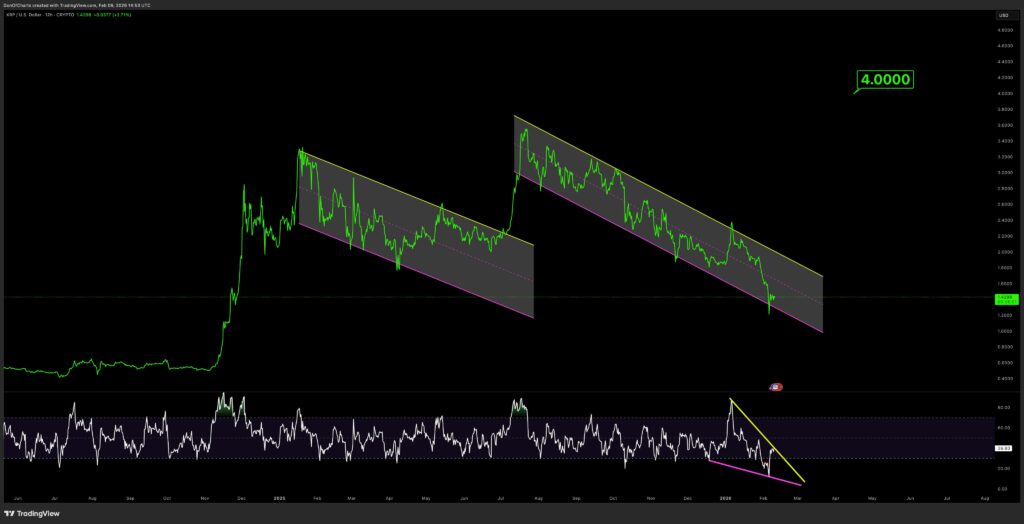

(Source: XRPUSD / TradingView)

Unlike a viral meme coin, this strategy plays out over years, not weeks. It requires patience and a belief that traditional finance will continue to migrate onto the blockchain.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Ripple Pushes XRP Toward Institutional Settlement: Why That Matters Beyond the Price appeared first on 99Bitcoins.