Competition in crypto is cutthroat. It is especially true of crypto exchanges. Binance is the world’s largest by trade volume and client count. The problem is, it is centralized and custodial. Every client using Binance must relinquish control over their private keys. Meanwhile, over the past few months, Hyperliquid has been gaining ground. Not only is the platform decentralized and taking Binance head-on, but its offerings have also been improving.

Yesterday, Jeff Yan, the founder of Hyperliquid, made a bold claim. In a post on X, he suggested that Hyperliquid crypto DEX had “quietly” achieved a historic milestone: Becoming the most liquid venue for crypto price discovery globally, flipping Binance.

Hyperliquid has quietly achieved an important milestone of becoming the most liquid venue for crypto price discovery in the world. See below for side by side comparison of BTC perps on Binance (left) and Hyperliquid (right).

With HIP-3 teams leading the way, Hyperliquid has also… https://t.co/xu41eTqPfI pic.twitter.com/aJCFYjMoxV

— jeff.hl (@chameleon_jeff) January 26, 2026

DISCOVER: 20+ Next Crypto to Explode in 2026

The Rise and Rise of Hyperliquid Crypto DEX

The evidence to support this claim? A side-by-side comparison of Bitcoin crypto perpetual contracts, showing Hyperliquid with tighter spreads of roughly $1 and a deeper order book of 140 BTC. On the other hand, Binance had wider spreads and shallower depth.

Tighter spreads and deeper pricing depth are primarily credited to the surge in use of the HIP-3 protocol. After implementing this update, users could trustlessly create perpetual markets via HYPE crypto staking. To launch any perpetual product, all they have to do is stake 500,000 HYPE. So far, HIP-3-related open interest, or simply, the number of all open leveraged positions, has spiked nearly 3X, from $260M to $790M in a single month. Most of this growth was fueled by surging demand for on-chain commodities, primarily gold and silver.

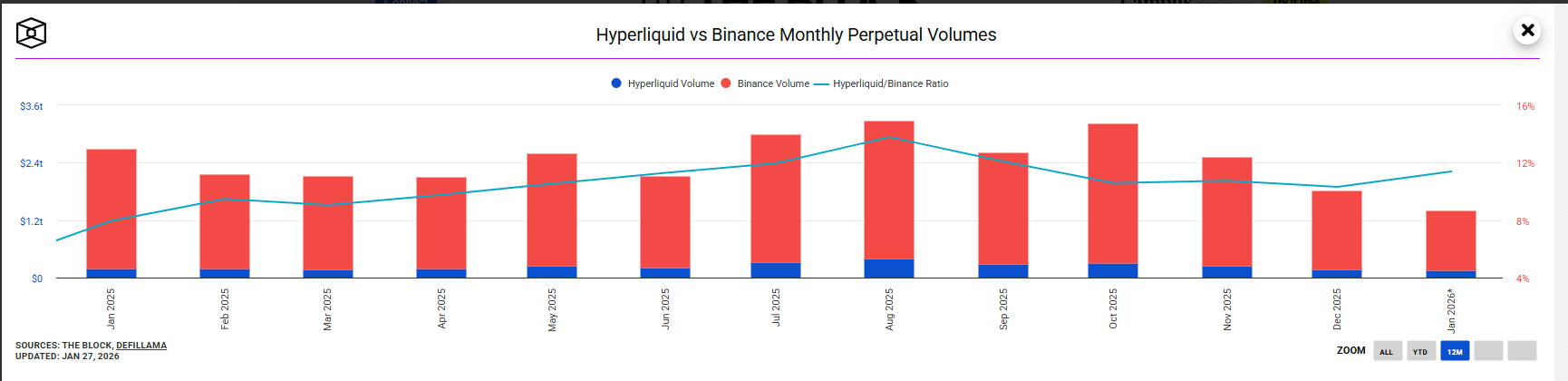

With better spreads and deeper liquidity, Hyperliquid is now the most dominant decentralized perpetual market, looking at open interest. What’s more? It has been growing versus Binance. The Hyperliquid crypto DEX volume ratio against Binance rose from +8% to +14% in early 2026, pointing to increasing adoption.

(Source: The Block)

Under the hood, Hyperliquid crypto DEX relies on a highly performant blockchain that offers sub-second finality and high transaction order processing. The DEX can process over 200,000 orders per second, and users experience “CEX-like” offerings without giving up control.

DISCOVER: 10+ Next Crypto to 100X In 2026

Binance Still Leads, Here’s Why

Still, not everyone is convinced that Hyperliquid crypto DEX has surpassed Binance. Taking to X, critics responded to Hyperliquid’s CEO claims, saying he his highly a vanity metric that masks fundamental design differences between the two ramps.

For example, Hyperliquid prioritizes “cancel” orders to protect market makers from toxic flow. On the other hand, Binance market makers have to face higher adverse selection, even from toxic flows. At the same time, on Binance, market makers have to stay more conservative because they can be “sniped” by aggressive bots.

Not discrediting what Hyperliquid has achieved – clearly it's both a major source of liquidity and price discovery, as shown with several ~$1B positions having been opened (congrats!) – but this type of surface level comparison of book depth as a measure of liquidity is pretty… pic.twitter.com/pvRI4YWRim

— CryptoNoddy (@Crypto_Noddy) January 27, 2026

On Hyperliquid, it is different. Market makers can quote large sizes because they know they can pull orders instantly if the price moves against them. Because market makers can cancel orders on Hyperliquid to protect themselves, critics say the DEX’s liquidity can appear deep but is, in reality, primarily comprised of “phantom” orders.

Beyond liquidity, Binance still boasts of higher daily volume of over $10Bn, of which Hyperliquid crypto DEX can only pull around +50% of this. The superior daily average volume could also be attributed to the high client count, relative to Hyperliquid crypto DEX. Binance has over 170M clients across the globe.

(Source: Coingecko)

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Did Hyperliquid Crypto DEX Just Flip Binance As The Most Liquid Exchange in the World? appeared first on 99Bitcoins.