Is the “drought” over? It appears so. After days of discouraging outflows, it seems institutions are turning to crypto. This is an interesting development because, for years, crypto has largely been a retail affair. Now, Wall Street views top cryptos as strategic assets worth adding to their multi-billion-dollar portfolios.

While spot Bitcoin ETFs hog investor attention, interest is building in altcoins. Since regulated firms cannot simply buy crypto off exchanges, their route is through regulated channels like spot ETFs.

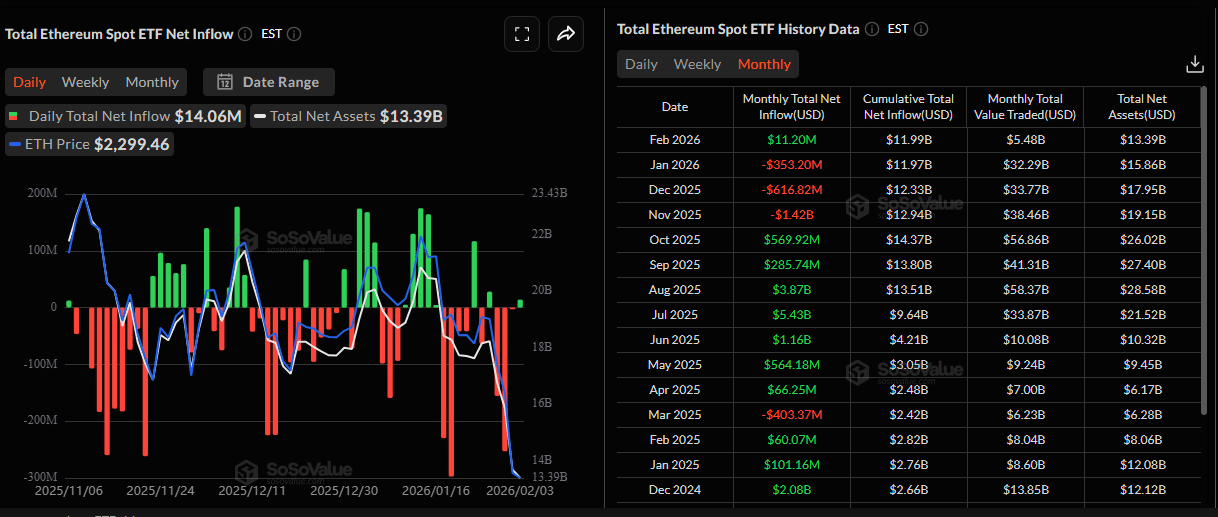

Yesterday, after days of bleeding, spot Ethereum ETFs saw inflows. Meanwhile, the Ethereum price hovered at the $2,300 level, technically bearish but fundamentally bullish. This state of price action comes after months of choppy trading and growing caution from institutions.

DISCOVER: Top 20 Crypto to Buy in 2026

Spot Ethereum ETFs In Focus

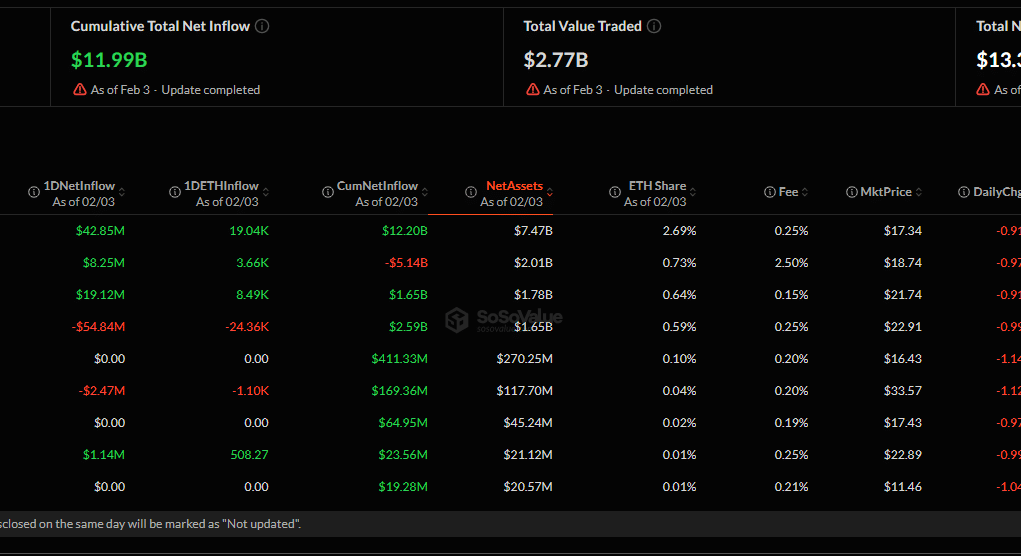

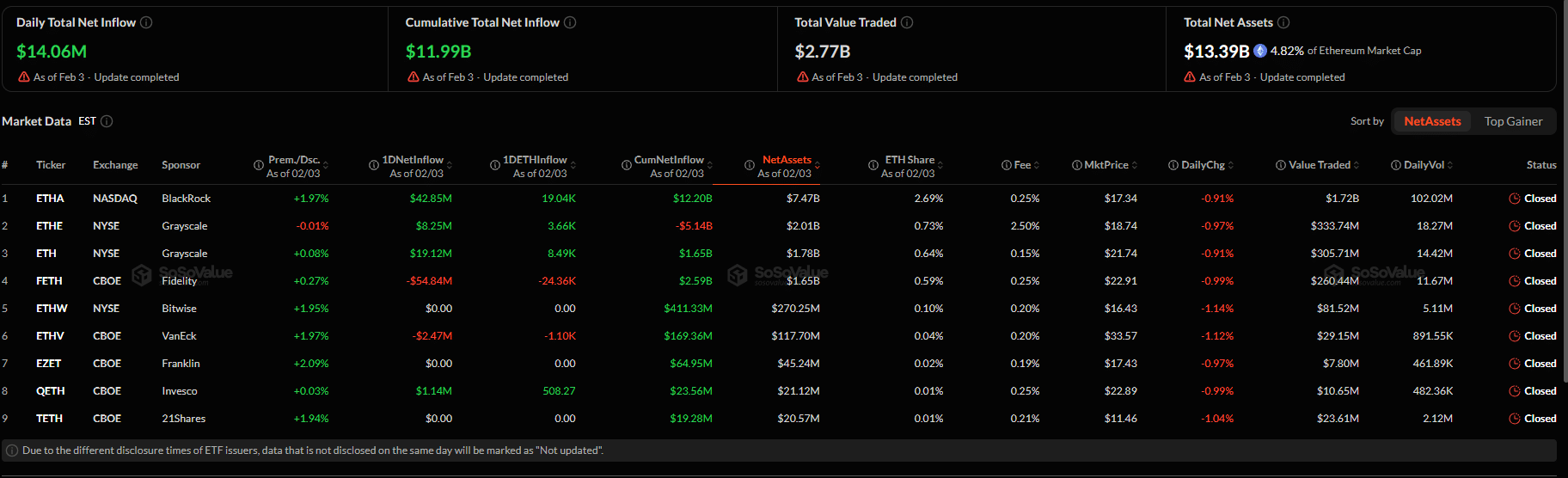

In July 2024, the US SEC approved the first batch of spot Ethereum ETFs. While staking was not initially permitted, the funds allowed institutions to gain exposure to ETH without the hassle of managing private keys. Among the big asset managers allowed to issue spot Ethereum ETF shares were BlackRock and Fidelity. So far, they cumulatively manage over $13.3Bn of Ethereum-backed shares.

According to market data, spot Ethereum ETF issuers saw inflows of over $14M on February 3. Out of the nine issuers, VanEck and Fidelity saw noticeable outflows. There was no business done by Bitwise, while BlackRock was the preferred vehicle for institutions. Over $42M of spot Ethereum ETF shares were bought through BlackRock, representing the biggest chunk of this inflow.

(Source: SosoValue)

This reversal ends a multi-week “exit streak” that saw hundreds of millions of dollars leave the funds in January 2026 alone. To put it in numbers, over $353M of spot Ethereum ETFs were redeemed in January. Interestingly, this was roughly half of what institutions chose to redeem in December. In that month, spot Ethereum ETF issuers saw outflows of over $616M. The amount of outflow in December was also nearly half of the bleeding seen in November, when over $1.4Bn of spot Ethereum ETFs were sold for cash.

(Source: SosoValue)

ETF flows are closely monitored, not just by traders but by investors. They show, in real time, how big investors feel without having to guess from tweets. When money stops leaving and starts coming back, it hints that fear is cooling. While it is not a guarantee that money will flow back in buckets, it hints that the general tone is changing. Overall, this might help steady prices.

Over the past three months, outflows have been slowing down, looking at outflows. Still, there has been divergence with price action. Ethereum is already struggling for momentum, and sellers have been unyielding. After the surge to around the $3,400 level, the Ethereum price has plunged by over 40%, printing new 2026 lows.

DISCOVER: 9+ Best Memecoin to Buy in 2026

Will ETH USD Bounce and Clear $3,500?

With redemption generally slowing down and the ETH USD price stabilizing, confidence is high. Since ETF flows gauge institutional sentiment, the recent inflow can be seen as a signal that the big boys are ready to dive in. This shift also helps explain why some investors are rethinking the recent Ethereum price pressure. Now that large funds are not selling, it might mean that the downside momentum is weakening.

The return of inflows comes at a critical time for Ethereum in general. Besides spot Ethereum ETFs, public firms are also adding ETH to their balance sheets.

BitMine currently holds over 4.2M ETH, buying over 141,000 ETH in the last 30 days. While a big portion of their stash is staked, earning a yield, Tom Lee, the chair of BitMine, addressed concerns about their big ETH holdings. With falling ETH USD prices, their Ethereum cost basis is higher than current prices, meaning the firm is currently in the red.

Lee dismissed the bearish sentiment from critics, calling the current drawdown a “feature, not a bug.” He added that they are holding ETH for the long haul and not speculating.

On X, one analyst thinks ETH is undervalued now that post-Fusaka, on-chain activity has spiked, while ETH USD prints lower lows. In his view, the coin is in a “coiled spring” setup seen in 2018/2019 but on a “larger scale.”

$ETH is officially the most undervalued it has been since 2019.

Ethereum network activity is at literal All-Time Highs (3.4M active addresses w/ contracts) while the price is 50% off its peak.

This is the same "coiled spring" setup from 2018/2019, just on a much larger… pic.twitter.com/gcKXZh4k8O

— HomeValidator.eth (@iDecentralized) February 2, 2026

If his forecast is bullish, then not only will Ethereum spike above $3,500 but also go on to print fresh all-time highs above $5,000.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Ethereum ETFs Finally See Inflows After Long Exit Streak appeared first on 99Bitcoins.